The Indian coffee and tea markets are dominated by Tata Coffee. The firm has a significant presence in both the local and international markets and is renowned for its high-quality goods. We’ll examine Tata Coffee share price in further detail in this piece, and we’ll attempt to identify the variables that have shaped the company’s recent success.

Tata Coffee Share Price Overview

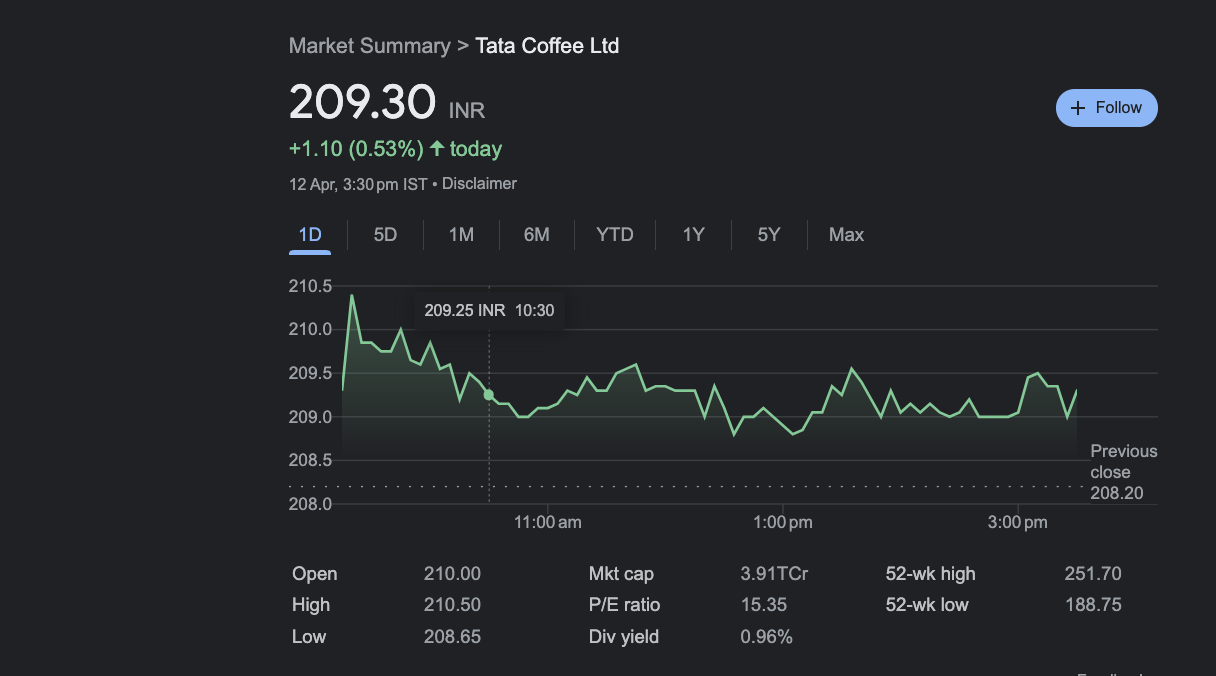

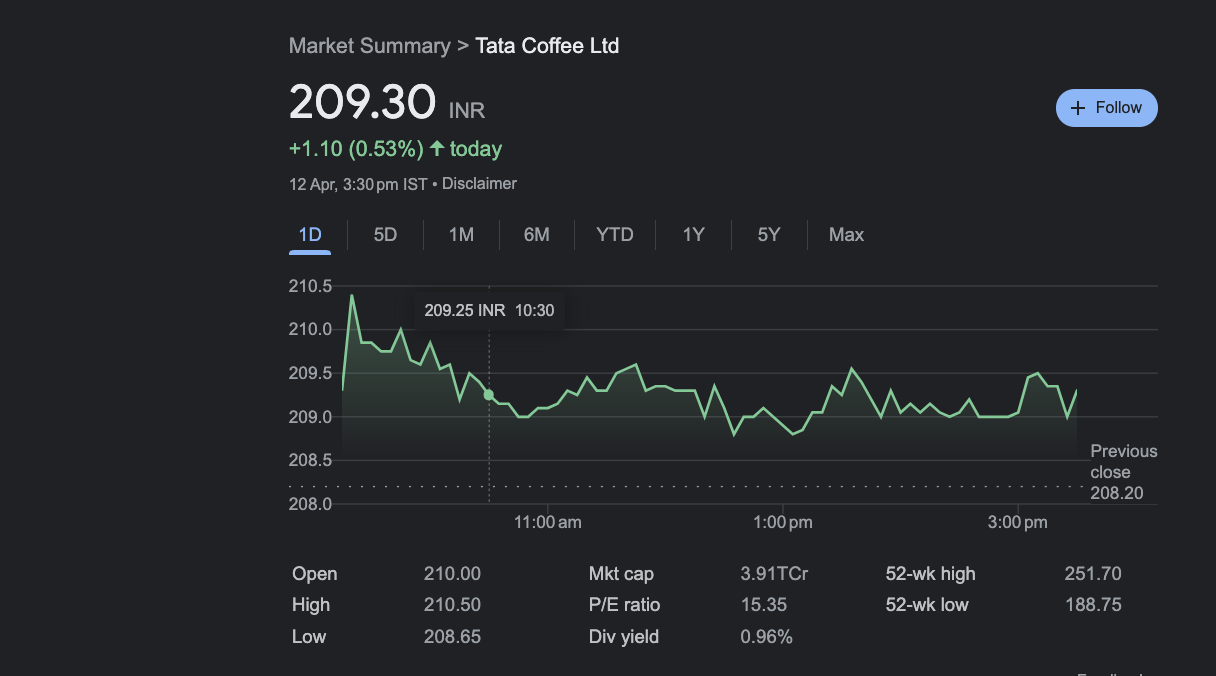

The stock was trading at 209.00 INR as of April 12, 2023, a tiny rise of 0.80 INR, or 0.38%, from the previous day’s closing. The firm has a market worth of 3.90 trillion Indian Rupees and a P/E ratio of 15.32. Tata Coffee has a 0.96% dividend yield.

Factors Affecting the Tata Coffee Share Price

Market trends, corporate performance, global economic circumstances, and regulatory changes are a few of the variables that might affect Tata Coffee share price.

Tata Coffee share price is significantly impacted by the success of the stock market as a whole. Concerns about growing prices, the effect of the COVID-19 epidemic, and the state of the global economy have all contributed to recent market volatility in India. Tata Coffee share price has dropped due to the market’s unpredictability.

Tata Coffee share price is influenced by its financial performance, as is the case with other companies. Investors often focus on a company’s sales, profitability, and growth potential. In the instance of Tata Coffee, the company’s revenue has been steadily increasing over the last several years. Nonetheless, the company’s profitability has been harmed by increased input prices, which have squeezed its margins. Investors have also been keeping a tight eye on Tata Coffee’s development ambitions, especially in overseas markets.

The state of the global economy has a significant impact on Tata Coffee’s operations. The firm sells a significant amount of its coffee and tea internationally, so fluctuations in the world economy might have an effect on its bottom line. Tata Coffee has recently faced challenges as a result of the continuing trade tensions between the United States and China as well as the uncertainties surrounding Brexit.

Changes in Regulations: Tata Coffee share price may be affected by changes in rules. For instance, any modifications to the government’s regulations on the export of coffee and tea may have an effect on the company’s earnings. The company’s bottom line may also be impacted by changes in tax laws.

Tata Coffee’s Latest Developments

Tata Coffee has been making a number of efforts recently to solidify its position in the Indian coffee and tea markets. The corporation said in 2021 that it will invest in a new coffee drying factory in Karnataka. The 30,000-tonne annual capacity of the new plant will allow the business to fulfill the expanding global market for Indian coffee.

In the specialty coffee market, Tata Coffee has also been growing. Under the “Araku” brand, the business introduced a new line of specialty coffees in 2021. The firm has been actively promoting its Araku collection, which comprises premium coffees produced from select farms in India, on both the local and international markets.

Tata Coffee has also been making investments in environmentally friendly coffee-producing methods. The “CoffeeWise” sustainability initiative was introduced by the corporation in 2021. The program’s goal is to encourage farmers and suppliers of Tata Coffee to adopt more environmentally friendly methods of producing coffee.

Strengths:

- Virtually Debt-free: Tata Coffee has a strong balance sheet with no significant debt, which makes it less vulnerable to interest rate fluctuations and other financial risks.

- Healthy Interest Coverage Ratio: The company’s interest coverage ratio of 27.94 indicates that it is generating enough earnings to cover its interest expenses, which is a positive sign for investors.

- Strong Liquidity Position: Tata Coffee has a current ratio of 3.33, which means that it has sufficient current assets to meet its short-term liabilities.

- High Promoter Holding: The company’s got a super high promoter holding of 57.48%, meaning the people in charge really have a stake in its success, aligning with shareholders’ interests.

Limitations:

- Poor Revenue Growth: The company’s revenue growth over the past three years has been slow – only 5.14%. That might worry investors who’re looking for companies with high growth potential.

- Negative Cash Flow from Operations: Tata Coffee has negative cash flow from operations of -42.87, which indicates that the company is spending more money on its operations than it is generating from its core business activities.

Is Tata Coffee a Good Investment?

The share price of Tata Coffee has been all over the place over the last year, showing the problems they’ve faced with higher input prices and the state of the global economy. But they’ve still got a good rep as a brand and a wide distribution network, so they’re still a big player in India’s coffee and tea biz.

Before putting their money into Tata Coffee, investors should do their own due diligence. They should take into account the company’s financial health, development potential, and industry competition.

Conclusion

Tata Coffee is a significant participant in the Indian coffee and tea businesses, having a significant presence in both the local and foreign markets. The difficulties encountered by the sector and the general economic climate have been reflected in the volatility of the company’s share price during the last year. Nonetheless, Tata Coffee has been making deliberate measures to increase its position in the market and has been investing in sustainable coffee-producing processes. If you’re an investor in Tata Coffee, you should do your own research and analysis and keep an eye out for any regulatory changes that might affect the company’s bottom line.